Why We Invested: Soul Wallet

We are very excited to announce our newest Web3 investment, Soul Wallet. Soul Wallet is aiming to become the leading decentralized, permissionless and censorship resistant wallet with Account Abstraction capabilities. The Company’s platform significantly improves security, ease of use and enables a superior onboarding experience into Web3 dApps, specifically inside the Ethereum and L2 ecosystems.

Current decentralized, non-custodial wallets mostly use an External Owned Account (EOAs) model which has many shortcomings and only caters to a very crypto-native user base. Some current issues preventing mass adoption of users include inconvenient key management, inflexible access control, gas payment inflexibility as well as non-intuitive user experience designs and customer journeys. Let’s deep dive into each of these with illustrative examples.

In current EOA wallet models such as MetaMask, Coinbase wallet or Ledger, when originating a wallet, users are provided with a mnemonic phrase as well as a public and private key per wallet account. A mnemonic phrase is typically a string of twelve to twenty-four words chosen at random. This set of words acts as a recovery mechanism to the EOA wallet if the user loses or forgets their sign-in password to the wallet or loses their physical device entirely. Users are expected to not only keep their mnemonic phrase in a safe physical location away from internet and device hacks, but to also remember where the phrase is stored. This creates a single point of failure that runs counterintuitive to the ethos of the industry in the first place.

Ironically, many users who hold large sums of asset value inside these wallets would either turn to bank vaults to custody their seed phrases, or depend on a centralized custodian to store these phrases, defeating the purpose of the crypto ethos to begin with. This is of course not very scalable, and an inconvenient user experience for most. As a result, billions of dollars worth of Bitcoin, Ethereum and other digital assets have been lost forever, trapped inside EOA wallets, simply because their owners did not have proper key management hygiene.

The second piece related to account management is the inflexibility of users to access their accounts if for some reason they needed someone else to access the assets in case of emergency. In a traditional finance world, bank accounts have the option to include multiple beneficiaries and co-signers of the same account, as well as ways to recover a user’s password or create a new password with preset authorization techniques. Such social recovery techniques do not exist in the decentralized EOA wallets of today, making it difficult for new users to onboard into Web3 with significant assets without worrying about significant potential risks of loss.

Another inconvenient user experience associated with an EOA wallet is its inflexibility in relation to on-chain transaction fees (gas fees). Wallets native to Ethereum, BSC, Solana, Polygon, Bitcoin and Filecoin all require transaction fees to be paid in their native token. When users attempt to transact or participate in the broader ecosystem of dApps inside those blockchain communities, they do not have the option to pay in stablecoins or other alternatives including fiat currencies.

This is currently a major hurdle for new users since they are often required to send a small amount of the native token into the wallet first before any transactions can take place. This creates a chicken or the egg problem for new users since they typically need to on-board through a centralized exchange first to even get a small amount of the native token of that blockchain before sending it to a decentralized wallet they are attempting to use. Again, this type of issue does not help with mainstream adoption of Web3 and runs counterintuitive to its intended purpose.

All of the above stated issues contribute to a suboptimal UI/UX for crypto users, preventing the mass adoption of users who expect comparable on-boarding and in application experiences present in Web2 and traditional finance mobile applications. As the entry point and access portal into the decentralized Web3 world, wallets in general need to improve significantly if the industry ever expects to reach its potential of mass adoption.

Soul Wallet is solving this problem by leveraging Account Abstraction capabilities powered by ERC-4337 on Ethereum mainnet and Ethereum Virtual Machine (EVM) equivalent Layer 2s like Arbitrum, Optimism, Scroll, Taiko, and many more. ‘Account abstraction enables smart contracts to initiate transactions themselves, so that any logic that the user wishes to implement can be coded into the smart contract wallet itself and executed on Ethereum.’ — Ethereum Foundation

This is achieved through the use of decentralized identity and key management systems, such as self-sovereign identity (SSI) protocols. With SSI, users have complete control over their own digital identity and the associated keys, which can be used to access various platforms and services. This eliminates the need for centralized intermediaries to manage user identities and the associated security risks.

Account abstraction also enables interoperability between different decentralized platforms, such as blockchain networks, allowing users to easily move their assets and data between different systems, creating more fluidity and choice of the ecosystem. Some projects that implement account abstraction on Web3 are wallet connect protocol and wallet link. They are open-source initiatives that allow users to connect their favorite wallet to dApps and services.

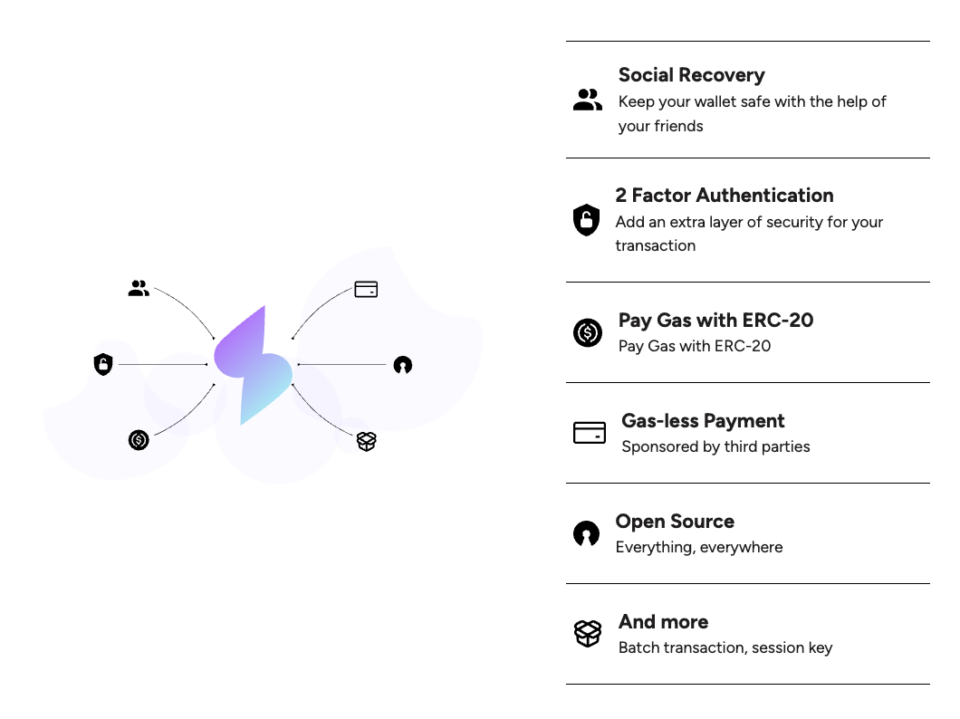

By building smart contract capabilities as part of the in wallet experience, users will be able to create wallets without mnemonic phrases, receive funds without deploying contract, change the signing key via social recovery methods and pay transaction fees with other ERC-20 tokens such as USDC/DAI, among other user experience improvements.

These improvements to the end Web3 wallet experience will allow significant product enhancements and user peace of mind as there will finally be safe recovery mechanisms and ease of use capabilities to allow the next wave of mass adoption into decentralized Web3 ecosystems. These improved capabilities will unlock many more Web3 use cases including signing in with Ethereum, on-chain data and credentials as well as credit scoring systems in a decentralized fashion, to name a few.

TEAM OVERVIEW:

Soul Wallet has a very impressive team. The co-founder and CEO, Jiajun has worked at ByteDance in a product role and is very well connected in the Ethereum ecosystem. He got connected directly with Vitalik Buterin over Twitter who reached out to Jiajun, which drove him to further develop his project after direct support from Vitalik. Jason, the co-founder and CTO, has 18 years of software experience working in the capacity of a full stack engineer and systems architect. He worked at JD.com and a SaaS education company for 10 years as the technology director.

Other members of their team have extensive software development experience as well as blockchain experience. Wei Ding worked at Huawei as a linux kernel developer, which demonstrates the team’s strong understanding of core systems. Wei also worked on the leading blockchain compute platform out of China as a developer and then on the Polkadot ecosystem. In his free time, Wei worked on arbitrage and MEV bots between Bancor and UniSwap.

Cejay has nearly 10 years of development experience. Although he has mainly worked in the field of distributed systems, he has also accumulated some useful skills for building contract wallet in his career. e.g. he has participated in contract audits for institutions, optimized compression algorithms for specific scenarios, and written decentralized game protocol based on SMPC, etc. His background will add more robustness to the team’s development practices.

Robbie Li worked as a software developer for 6 years on the Web2 side before moving into blockchain where he developed several wallet products for Polkadot, Ethereum and other ecosystems. His experience in the wallet space will be invaluable to the company. Andy has been working at Google as a software engineer for 3+ years based out of the Bay Area focusing on infrastructure. His experience will undoubtedly bring a lot of reliability and robustness to the team’s infrastructure and engineering practices.

The team has a very good combination of the various skills needed to build a successful blockchain wallet company, combined with very strong support directly from the Ethereum Foundation and also directly from Vitalik. This gives the SoulWallet team a unique advantage as a company. The team presented SoulWallet at Devcon Bogota in October 2022 and won first place for Account Abstraction wallets, which further gives us strong conviction in the team’s ability to execute.

This group of impressive crypto native developers and community builders couple their Web3 backgrounds with more traditional product and scaling experiences and formal education from top universities in Asia and the US/Europe including Beijing University, Shanghai Jiao Tong University, Zhejiang University, Northeastern and the University of Tartu in Estonia.

In addition to having a robust core team, they are supported by core Ethereum Foundation developers and contributors to EIP4337 including Yoav Weiss, Danny Ryan, Kristof Gazso, Namra Patel, Dror Tirosh, Shahaf Nacson, Tjaden Hess and Vitalik Buterin (Co-Founder of Ethereum), who are major contributors in the Company and open source wallet infrastructure.

MARKET OVERVIEW:

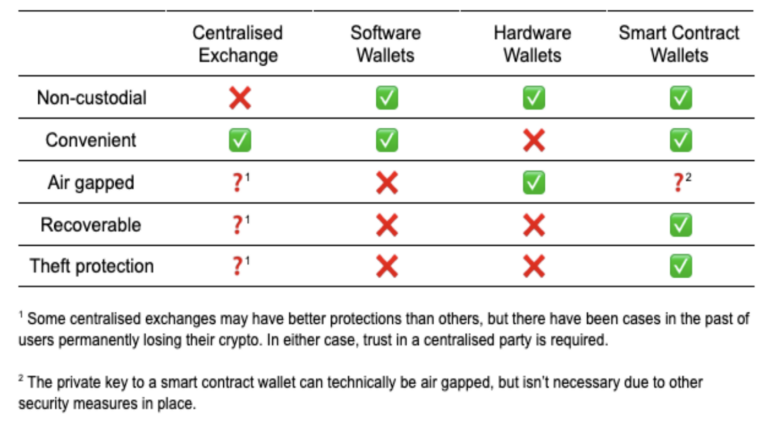

Currently, in the Web3 space, there are major gaps in both wallet security and self custody preventing mass adoption. Given recent events with centralized exchanges going under such as Celsius, BlockFi, Voyager, and FTX, consumer confidence is at an all time low when it comes to centralized custodians of digital assets. Their alternative is to venture into the decentralized non-custodial space for digital assets, which can often be confusing to navigate for even the most sophisticated of users.

The common phrase ‘not your keys, not your crypto’ has never rang more true than today, as billions of customer funds have been wiped out or frozen under bankruptcy proceedings from poor management of centralized crypto institutions. Consumers need an easier way to navigate the Web3 landscape without the risk of losing private keys or the hurdles of creating a decentralized wallet with strings of letters and numbers to safekeep.

Hardware and multi-signature wallets are a very safe solution to hold digital assets as part of current wallet offerings. However, they are inconvenient to use and still leverage EOA accounts which further increases user on-boarding friction as stated above. Account Abstraction techniques help solve many of the aforementioned issues with EOA wallets, but competing offerings come in various forms and do not necessarily solve a holistic set of adoption issues with respect to decentralization and EVM equivalence.

The novel concept of Account Abstraction inside wallets is an important feature of Web3 that aims to make decentralized systems more user-friendly and interoperable, while also providing users with more control over their own digital identity and assets. Some possible use cases for Account Abstraction include:

- Decentralized finance (DeFi): Users can access and interact with multiple DeFi platforms and protocols using a single set of credentials, such as lending, borrowing, and trading assets.

- Gaming and Collectibles: Users can easily manage and trade in-game items and collectibles across different platforms using a single wallet.

- Social Media: Users can create and manage a decentralized profile and identity across multiple social media platforms without the need to create separate accounts.

- E-commerce and Marketplaces: Users can make purchases and sell goods on different marketplaces using a single set of credentials.

- Identity and Access Management: Account Abstraction in Web3 wallets can also be used for identity verification and access control for different platforms and services, allowing for more secure and seamless user experiences.

- Data Management: With Account Abstraction, users have more control over their own data and can move it between platforms and services with ease.

As the decentralized ecosystem continues to grow and evolve, more use cases will emerge. The main advantage of this feature is that it allows for more seamless user experience and more interoperability across different platforms, making it easier for users to manage their digital assets and identities, while also providing more security and control.

The total market capitalization for decentralized wallets surmounted $8.6B in 2022, and is projected to grow at a 24.4% CAGR until around 2030. As the number of crypto wallet users reached 84.02 million worldwide, the industry needs to solve for many pain points detailed above to expect to reach global adoption in the billions of wallet users. Web3 wallets are the coveted entry point into the decentralized, permissionless web and arguably one of the most important onboarding vehicles for mass adoption. As seen with early winners like MetaMask and Phantom Wallet, network adoption through wallets with great UI/UX can be major moat builders. From 545,080 monthly active users in July 2020 to roughly 21,354,279 in 2022, MetaMask now boasts a user base of more than 30 million active users globally, connecting users to more than 3700 decentralized applications in Web3.

As Web3 matures and more use cases can be enabled by a smooth Web3 onboarding and wallet experience, areas like signing in with Ethereum, decentralized credentials and on-chain data will all tie back to the decentralized wallet and on-chain identity use cases. The total addressable market would be infinite as global digital adoption will increase exponentially over time, as more Web2 and traditional brick and mortar customers discover the endless use cases within Web3, disintermediating the middlemen in most industries and 10x’ing user experience.

Digital industry disruption across financial services, healthcare, supply chain, energy, consumer, government, information technology will likely exceed that we have ever seen before, with trillions of dollars of serviceable addressable market up for grabs globally, opening the floodgates for a decentralized business model revolution.

PRODUCT:

The Soul Wallet team has clearly taken the right steps to implement ERC-4337 and has provisions to abstract away the gas costs of transactions through some of their proprietary innovations. They are also introducing additional layers of security in terms of account recovery that is not common in the Ethereum ecosystem. Soul Wallet has a robust UI and clearly has a very strong focus on building out product.

ERC-4337 specifies wallets to be represented as on-chain smart contracts instead of the traditional Externally Owned Accounts (EOAs). On-Chain smart-contracts wallets are similar to Gnosis Safe wallets, whereas EOAs are those used in traditional wallets such as Metamask. It is complex for users to use an on-chain smart-contract and they prefer a wallet that they can interact with using a UI. Furthermore, with the fast adoption and growth of Metamask it seems clear that users have a strong preference for convenience over security and a browser extension is a good interface for wallets.

Therefore, the Soul Wallet team implements the actual wallet logic on-chain to be compliant with the ERC-4337 specification and to serve the user preference they have a browser extension to control and interact with the underlying on-chain wallet. Users of Soul Wallet will, according to the protocol, send UserOperation objects into a separate mempool and a third-party entity bundles up these UserOperation objects from this new mempool and sends it to a special smart contract to have these UserOperation actions be added to an Ethereum block; it is this process that is the crux of the ERC-4337 protocol that enables account abstraction on the Ethereum network.

Soul Wallet leverages a familiar wallet user experience such as that of MetaMask or Phantom wallet coupled with intuitive Web 2.0 log on interface with email and password log in, saving users the hassle of creating seed phrases and risk of losing those phrases.

There is also an intuitive interface for setting up ‘Guardians’ as social recovery accounts of the wallet, which can include other wallets from the same user or different user accounts. Soul Wallet allows for an infinite number of ‘Guardians’ and ability to set recovery thresholds such as 50% of all signers to approve or as high as 90%. Such flexibility creates a sense of security depending on the user’s risk tolerance and convenience needs.

Additionally, Soul wallet allows for transaction fee payments from any ERC-20 tokens such as USDC, WETH, DAI or any compatible token on Ethereum mainnet or any compatible L2. This further increases flexibility for users to keep more of their desired digital assets while keeping fees to a minimum without worrying about volatility of transaction fees at the native token level.

Finally, as the Soul Wallet team continues to perfect the fundamentals of the product features, they intend to bring in additional features on the roadmap such as native multi-sig capabilities, building various SDKs for dApp integration, as well as launch onto multi-chain ecosystems.

BUSINESS MODEL:

One of the key advantages of Soul Wallet’s business model is its flywheel effect. As more dApps and blockchain ecosystems are integrated, it begins to create an ecosystem effect, attracting other project teams and ultimately more Web 3 users.

The Soul Wallet team has the benefit of leveraging multiple strong partnerships within multiple Web 3.0 ecosystems and can achieve monetization over time through SDK integrations with various Dapps across the Ethereum and L2 ecosystems. Leveraging a similar monetization model to MetaMask, Phantom and other existing wallet players in the space, Soul Wallet will achieve profitability primarily through transaction fees within wallet on-chain transactions. In addition to transaction fees, swap fees and SKD revenue share, Soul Wallet will leverage its innovative Pay Master for additional monetization as more users onboard onto the product. Details on Pay Master below:

In EIP-4337, Paymaster is the fundamental component that allows users to pay for gas with any asset (ERC20 or any token). The paymaster can convert users’ assets to ETH to pay the gas fee required by the ETH network.

After a user initiates a transaction and specifies an ERC20-paymaster (or using default paymaster), the smart contract will run according to the predefined logic and collect some ERC20 Token from the user and convert it to ETH using a certain exchange rate to help the user pay for the ETH network. Soul Wallet will then take a small percentage of the exchange rate as an additional revenue source.

The process of initiating a transaction and assigning a Paymaster is done automatically by the wallet in the short term. In the long term, the wallet will have Paymaster built in, but users and DApps can always change it according to their needs. (e.g. the RPC endpoint in MetaMask uses infura.io by default, but the user can specify it manually)

The number of ERC20 Tokens deducted by Paymaster from the user depends on the exchange rate (Paymaster’s expected profitability), Exchange rates can be obtained from on-chain data (e.g. Oracle, Some DEX). It can also be obtained through off-chain data (e.g., when using a Paymaster, the Owner’s signature is required for the exchange rate he approves).

GO-TO-MARKET STRATEGY:

We believe that Soul Wallet has potential to find product market fit within the Web3 decentralized wallet space. They have started with a freemium model to attract initial projects to integrate with Soul Wallet, and will continue this network adoption strategy until they solve the cold start problem and reach the tipping point of exponential compounding growth. We believe this is the right approach for ongoing partnerships and exponential growth within the Web 3.0 ecosystem.

Soul Wallet has been focusing on their go-to-market strategy since the beginning of the project, as they have strategically attracted a robust pipeline of key industry players to create long term partnerships with. Below is a list of targeted projects and ecosystems.

Partnerships with Layer-2s: Scroll, Optimism, Arbitrum, Taiko, Linea.

Soul Wallet is intending to partner with some of the top L2 ecosystems in Web3. They are targeting some of the higher volume L2 blockchains since many wallet providers will be battling for new users on those platforms. The Company has a robust, differentiated strategy to pursue multiple key ecosystem partnerships starting with Optimism and Arbitrum, two of the most popular L2 blockchains currently that comprise over 80% of L2 transaction volume. The team is intending to direct more users and Total Value Locked (TVL) to Optimism and Arbitrum, create better user experience for new and existing users in those ecosystems, all while achieving Account Abstraction capabilities without changing the underlying protocol in order to compete with the likes of zkSync and StarkNet native Account Abstraction capabilities.

The Soul Wallet team is also targeting co-marketing and sponsorship rights with top L2s to expand their brand and customer reach. As the team develops more robust business development capabilities, the team will continue to tap into their already robust Web3 native network, including the Bankless ecosystem, with over 200,000 subscribers and tens of millions of podcast downloads, The Daily GWEI, Kristof and Yoav Weiss of Ethereum Foundation, as well as the extended network of Ethereum Co-Founder, Vitalik Buterin. The team has already activated a few of these channels, including presence on a Bankless episode, Twitter and panel shoutouts by Vitalik and other EF core contributors.

Additionally, the team is connected to the Aave and MakerDAO teams, which are in discussions to list Soul Wallet as one of the main wallet plug-ins to onboard into blue chip DeFi protocols. The team is also in active discussions with WAGMI and RainbowKit, to get Soul Wallet listed and use their SDK to enable more integrations into various dApps across all verticals in Web3. As Soul Wallet’s dual sided ideal customer persona evolves, more dApp integrations will enable users to use Soul Wallet as their main entry point into Web3, creating a flywheel effect as UI/UX and security improvements with Account Abstraction build trust with users.

COMPETITIVE DIFFERENTIATION:

As of the end of 2022, the decentralized wallet space has ballooned to well over $10B in total market capitalization and over 50M monthly active users across various EOA wallet providers including MetaMask, Phantom, Coinbase Wallet, Trust Wallet, Zerion, Exodus to name a few.

MetaMask has captured by far the largest market share of this vertical, boasting a 30M monthly active user base and growing at a 20–30% CAGR. MetaMask as a core portal for users across the global to access Web3 applications and infrastructure, was one of the first products to hit the decentralized, non-custodial market, giving users the alternative to no longer rely on centralized exchanges such as Coinbase, Binance, Gemini, the now defunct FTX and other institutions acting as a pseudo bank without banking licenses or FDIC insurance to safekeep customer assets. As seen with recent events of 2022, centralized institutions with major counterparty risk, proved that worst case scenarios can happen in the blink of an eye and the value proposition for non-custodial solutions are more important than ever.

The relatively simplistic, user-friendly experience of onboarding onto MetaMask, with access to thousands of decentralized applications, has rocketed the growth of this Web3 product with technology savvy customers. However, its appeal has mostly catered to crypto native users and many onboarding and nuanced features within the wallet are not intuitive enough for mass adoption of non crypto savvy users. This has hindered the exponential growth of MetaMask as a mass market product to date. With Account Abstraction capabilities as mentioned above, the next generation of decentralized wallets will take a major step in closing the gap with crypto native and mass market consumers.

Argent wallet is another active player in the space leveraging Account Abstraction methodology to on-board new users. Founded in 2018 by serial entrepreneurs, Itamar Lesuisse and Gerald Goldstein, the Argent team has raised more than $50M in four rounds of financing including a recent Series B round in April 2022, led by Paradigm and Index Ventures. Argent’s main value proposition is an all encompassing wallet with the convenience of L2 scalability benefits such as zkSync and the secure capabilities of non-custodial wallets. The issue with Argent, however, is its relatively centralized method of operations as if Argent the company goes down, its wallet users will no longer be able to use the application and will have a difficult time accessing their digital assets.

As Vitalik Buterin and Yoav Weiss pointed out in an Account Abstraction crypto native group chat, ‘Argent would rely on single relayers instead of unified relayers as part of the EIP-4337 standard. The primary benefit of a standard is, indeed, that the wallet doesn’t need to maintain off-chain infrastructure and the users do not have to depend on it being maintained. Having a unified and incentivized mempool for all AA wallets improves censorship resistance. Any single relay might censor you, but in a mempool it’s likely that another bundler will include your transaction and get the priority fee. Another benefit is resilience against DoS attacks. If you rely on a single relayer, someone could censor you by attacking it. With a mempool, the attacker needs to DoS 100% of the bundlers, or else the transaction will go through.’ — Vitalik & Yoav

As Vitalik and Yoav pointed out, Ethereum native wallets leveraging the EIP-4337 standard will achieve benefits of true decentralization and censorship resistance from unified mempools, also allowing for composability across various layers of the L2 stack. Argent and all EOA wallets currently do not have this capability in its core infrastructure and will almost always run the risk of potential centralized censorship and DoS attacks.

There are other competing teams trying to implement the EIP-4337 standard and achieve EVM equivalence with their wallet design including UniPass, Candide, 0xPass and several other similar players. As competition intensifies in this relatively nascent market, projects will need to win over users the old fashioned way by shipping high quality products quickly, with 10x improvements in user experience over alternatives, as well as form strong partnerships with top ecosystem players to build significant traction at a blistering pace.

As more decentralized, open source projects become more popular for builders, their competitive edge will become increasingly more difficult to grasp as exponential network adoption and their ability to hit escape velocity will be what most teams will depend on.

Soul Wallet is planning to hit on many of these milestones as stated above.

CONCLUDING THOUGHTS

Web3 is in dire need of user experience leaps to bring on the next wave of mass adoption. With each incremental improvement, solving critical pain points in the user onboarding and experience journey, will bring us closer as an industry to rival some of the gold standards in Web2 and consumer products of peak Silicon Valley. Web3 users need to expand beyond the savvy ‘crypto native’ types and evolve into consumers who seek value-added experiences irrespective of the underlying blockchain infrastructure. The Soul Wallet team is leading with this vision in mind and are executing relentlessly to get us there through this critical point-of-access Web3 wallet experience. We are one step closer to mainstream adoption.

Not financial advice. Shout out to JiaJun Z., Adam S., Leo L. and Nikhil S. for their review and comments on this piece.

Disclaimer:

Struck Capital Management LLC is registered with the United States Securities and Exchange Commission (“SEC”) as a Registered Investment Adviser (“RIA”). Nothing in this communication should be considered a specific recommendation to buy, sell, or hold a particular security or investment. Past performance of an investment does not guarantee future results. All investments carry risk, including loss of principal.

About Struck Crypto:

Struck Crypto is a permanent capital evergreen vehicle with over $100M AUM and has been investing in the blockchain space since 2017. The firm was the first ever investor in leading deals such as Mythical Games and Zero Hash. The firm was also an early backer of leading Layer 1’s in the space such as Algorand and Hashgraph, as well as leading DeFi projects such as 1inch.

Struck Crypto prides itself on putting up more sweat equity per dollar invested than any investor out there. Its robust platform takes a hands-on approach to portfolio development with talent acquisition, business development, community building, technical help, and other functions to help projects hit escape velocity.

Sources and additional reading:

- JiaJun Zeng & the Soul Wallet core team

- Ethereum Foundation

- The Block

- Crunchbase

- Techcrunch