Why We Invested: GLIF

We are excited to cover GLIF in this edition of our Why We Invested series! GLIF is a non-custodial staking protocol native to Filecoin.

THE STORY BEHIND GLIF

Deep in the crypto winter of 2017, Jonathan Schwartz, the Co-Founder and CEO of GLIF found himself tinkering with innovative technologies in the blockchain space when few at the time had enough conviction to build in Web3. His curiosity and passion led him to Joseph Lubin, one of the co-founders of Ethereum, and his core developer community at Consensys.

Jon is a self starter and taught himself advanced solidity and other smart contract languages in blockchain. At Consensys, he further honed in on his crypto and software development expertise, where he worked on various industry critical products in 2017/2018.

Eager to expand his expertise, he became an early Filecoin ecosystem contributor, working with Jonathan Victor, Protocol Labs, and early Filecoin Foundation executives on core infrastructure and tooling in the Filecoin ecosystem. These important primitives include the first Filecoin web wallet and multisig wallet, a Filecoin block explorer, and public/private Filecoin nodes used by most of the application builders on the network today.

These core, innovative Filecoin products evolved to become GLIF. Jon rounded out his team with very experienced Co-Founders such as Peter Andersen and extensive support from Filecoin leadership like Jonathan Victor, Whyrusleeping (first Protocol Labs employee) and Juan Benet, Filecoin Co-Founder. Peter has over two decades of software development and technology startup experience with the likes of Nokia, CodeRepublic and 3BaysOver. Peter met the Filecoin Foundation team in 2019 and has been a core contributor to the Filecoin ecosystem alongside Jon and team.

Together, Jon and Peter have surrounded themselves with a top tier development team to build the next core product in GLIF Pools, a native staking protocol for Filecoin tokens, FIL.

OVERVIEW OF THE FILECOIN ECOSYSTEM

The Filecoin network is a decentralized peer-to-peer file storage network that aims to let anyone store, retrieve, and host digital information. Smart contracts, together with off-chain and on-chain applications can store and retrieve data in a decentralized manner and the token economy around FIL provides an incentive layer to guarantee data remains stored and retrievable.

The network is secured by providing storage proofs over time together with the FIL token. FIL tokens are used as payment to storage providers and as an economic incentive to ensure files are stored reliably over time. All storage providers must stake FIL tokens which can be slashed if a provider loses data before a storage deal has expired or fails to submit their Proof of Storage when asked.

The Filecoin network launched in October 2020, creating an incentive layer to the IPFS protocol and enabling open services for data. Filecoin has seen strong adoption with 581 active storage deals as of April 2023. Despite its growth, we believe Filecoin has reached a small part of its potential as only 1.6% of Filecoin’s storage capacity of 300PB is used. Some of Filecoin’s use has been hindered by its lack of smart contracts and interoperability with other layer 1 blockchains. Without smart contracts, liquid staking, and data indexing tools, cross chain apps are difficult to build and maintain.

To introduce programmability and improve usability of its network, Filecoin recently launched a software platform that will introduce smart contracts on the network. The software platform has been named Filecoin Virtual Machine (FVM). The FVM is a runtime environment for smart contracts. FVM brings user programmability to Filecoin, unleashing the enormous potential of an open data economy.

The launch of the FVM offers a great opportunity to invest in the growth of the Filecoin data economy as the network should be able to offer improved onboarding, innovative new storage primitives, and connectivity to other chains. Simultaneously, with the launch of FVM, Filecoin can now support direct staking, enabling FIL holders to earn rewards on their tokens by lending them to storage providers. GLIF is the first non-custodial Filecoin staking platform, representing an interesting opportunity for us to earn rewards on our FIL position.

MARKET OVERVIEW

Filecoin competes with both traditional Web2 storage providers like AWS and other decentralized, blockchain-based storage solutions like Arweave. While Web2 cloud storage solutions have much wider penetration and offerings than Filecoin, data storage is a massive market with many winners. The global cloud storage market is valued at $83.41 billion and is expected to grow to $376.37 billion by 2029, at a CAGR of 24.0% according to Messari.

Moreover, we believe decentralized storage networks can deliver many benefits over traditional methods. When an organization uses a decentralized network primarily for storage, one of the main benefits is cost savings. Decentralized storage networks act as a brokerage service between those who need storage and those who have extra capacity that they are willing to lease. As such, that storage tends to be inexpensive compared to traditional centralized options. Historically the cost of storage has proven to be significantly lower on a per-gigabyte basis than today’s market rates for Web2-based public cloud storage providers. And because organizations can specify the level of resiliency they need to meet availability requirements, they potentially have the flexibility to go far beyond what any Web2-based public cloud storage provider will guarantee.

Filecoin also competes with other decentralized storage solutions most notably Arweave. We believe the primary difference between Arweave and Filecoin is their focus. Arweave is focused on long-term data storage with a one-time payment model, while Filecoin is more focused on incentivizing large-scale storage and uses a tiered payment model based on storage time and space requests. There are advantages of each, but Filecoin is typically more cost effective and addresses the needs of a larger base of users and companies.

FILECOIN TOKENOMICS

Filecoin’s tokenomics were designed to accumulate a critical mass of hardware resources, while driving long-term demand for network resources (capacity, retrieval, and compute power).

Filecoin’s token, FIL, has three main uses:

- Pay for messages on-chain

- Used as collateral creating economic incentives for reliable data storage over time and to secure the blockchain

- Burned to regulate shared resources (blockspace)

Filecoin’s storage market exists off-chain, but is anchored on-chain by messages containing cryptographic proofs of storage. This design helps FIL accrue value without creating undue pressure on users of the network’s various services.

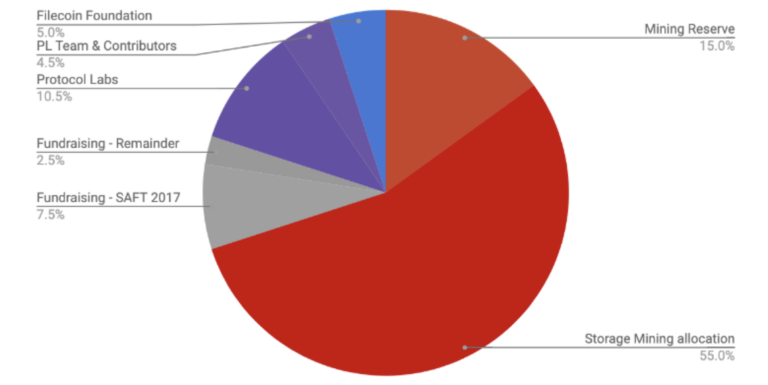

Filecoin’s FIL token has a maximum supply of 2 billion tokens. 70% (1.4B FIL) was allocated for storage and related services. 15.5% was allocated to Protocol Labs and the Filecoin Foundation to support the network’s adoption and growth. The remaining allocation went to investors and the founding team.

GLIF POOLS OVERVIEW

With the introduction of the FVM, GLIF is enabling, for the first time ever, decentralized on-chain staking of native Filecoin tokens.

GLIF Pools is a non-custodial, automated staking protocol for the Filecoin network, powered by the FEVM (the Ethereum virtual machine virtualized as a runtime on top of the Filecoin virtual machine). GLIF’s first staking Pool – the Infinity Pool, enables Filecoin Storage Providers to borrow FIL up to the value of the collateral they lock inside the Protocol. Storage Providers make weekly payments back into the pool for borrowing FIL – the amount they pay is dynamically set based on market conditions. These payments are rewarded to GLIF stakers as rewards on the FIL they deposit.

GLIF has full support of the Filecoin Foundation and has also been around the Filecoin ecosystem for a long time so they are the experts when it comes to the Filecoin network. In the past they have developed block explorers, wallets, node software, and a few other critical tools for Filecoin, which they still operate. They are using their existing tools to funnel users and include support for the Liquid Staking token that will come out of their version of staked Filecoin.

What’s more, GLIF is built in a way that makes them extremely modular. Eventually their staking technology will be available for anyone to deploy customizable Filecoin staking pools, similar to what Uniswap did for Ethereum token swapping. They also developed a uniquely Filecoin oracle system to relay real-time and historical information about Storage Providers to the staking pools – creating a mechanism for flexible and bespoke staking models. Due to the unique nature of the Filecoin network, teams won’t be able to fork a staking protocol from Ethereum or Solana and expect it to work on Filecoin – we believe this is GLIF’s competitive advantage and moat.

Liquidity pools provided by GLIF can be used by anyone to create additional DeFi primitives for the applications that projects will inevitably create on the Filecoin Virtual Machine and FEVM. Since Filecoin is a data storage network, they will also need basic functionality, such as storage and query capabilities, to be accessible directly from smart contracts deployed on the FVM.

ENABLING FVM AND FEVM ADOPTION

After staking FIL into the GLIF protocol, iFIL is sent to the stakers as a derivative of the underlying staked Filecoin tokens, mirroring the stETH model of Lido and Rocketpool. This allows secondary markets to be created for iFIL and broader access for liquidity of the staked asset.

For increased DeFi Adoption, iFIL could be more widely accepted as collateral in other DeFi protocols. This would mean that instead of swapping iFIL for FIL or another token, iFIL holders could use iFIL directly within these protocols.

The value and utility of iFIL would depend on factors such as:

- DeFi protocol acceptance: The number and popularity of DeFi protocols that accept iFIL as collateral could influence its utility and demand.

- Liquidity incentives: If DeFi protocols provide liquidity incentives (like liquidity mining rewards) for iFIL, this could increase its demand and value.

- Interoperability: The ability to easily move iFIL between different DeFi protocols could also affect its utility and appeal.

Here, iFIL can be leveraged widely within the Filecoin ecosystem and beyond if interoperability evolves in the crypto space. This might include lending it on a platform to earn interest, providing liquidity in a decentralized exchange pool, or staking it in a yield farming protocol. This could provide flexibility and utility to iFIL holders, and the actual outcomes would depend on a variety of market and network conditions.

Struck Crypto is ecstatic to be an early participant as a Infinity Pools Program member of GLIF Pools. We belive the future of DeFi on FVM and FEVM is promising. It will be further enabled by GLIF Pools and FIL native yield passed through from storage providers to innovative DeFi protocols tapping into the wider GLIF staking network. This will enable primitive use cases such as lending/borrowing, perps, derivatives, on-chain vaults, RWAs and more, similar to that of thriving ecosystems like Ethereum and L2s such as Arbitrum and Polygon. Further composable dApp innovation can spur out of these DeFi primitives on top of FVM and FEVM with the added benefits of decentralized storage, compute and analytics infrastructure, differentiating against other top ecosystems in Web3. We are excited for the potential of continued growth of the Filecoin Ecosystem enabled by core infrastructure innovation like FVM, FEVM and GLIF.

Special thanks to Jon Schwartz and Adam Struck for review and comments.

Key Sources

- Fortune Business Insights

- Messari, State of Filecoin

- GLIF core team

- Protocol Labs & Filecoin Foundation

- Cointelegraph

Disclaimer

The information provided in this blog post is for educational and informational purposes only and is not intended to be investment advice or a recommendation. Struck has no obligation to update, modify, or amend the contents of this blog post nor to notify readers in the event that any information, opinion, forecast or estimate changes or subsequently becomes inaccurate or outdated. In addition, certain information contained herein has been obtained from third party sources and has not been independently verified by Struck. The company featured in this blog post is for illustrative purposes only, has been selected in order to provide an example of the types of investments made by Struck that fit the theme of this blog post and is not representative of all Struck portfolio companies.

Struck Capital Management LLC is registered with the United States Securities and Exchange Commission (“SEC”) as a Registered Investment Adviser (“RIA”). Nothing in this communication should be considered a specific recommendation to buy, sell, or hold a particular security or investment. Past performance of an investment does not guarantee future results. All investments carry risk, including loss of principal.