The Evolution and Implications of Tokenized Decentralized Physical Infrastructure Networks (DePINs): Exploring Sustainable Network Models

Blockchain technology, initially designed to bolster the security and transparency of cryptocurrencies like Bitcoin, has burgeoned into a multidimensional tool with profound applications across various industries. It is a decentralized digital ledger system where transactions are recorded in blocks and are visible and immutable, ensuring unprecedented levels of transparency and security. Within this innovative technological environment, Decentralized Physical Infrastructure Networks (DePINs) are gaining traction. These emerging concepts are bridging the chasm between the digital ecosystem and tangible assets, establishing a holistic, interconnected economic landscape.

The capacity to harness physical resources, infuse them with digital attributes, and deploy them within decentralized networks opens avenues for innovations, efficiencies, and value creation unprecedented in scale and scope. As a technology that originated and thrived in the virtual domain, blockchain’s foray into the real world signifies a paradigm shift. This migration extends the decentralized ethos to tangible assets, allowing a convergence that bridges gaps, enhances efficiencies, and fosters a holistic ecosystem where physical entities become integral components of digital networks. The fusion of these worlds promises to redefine traditional operational, economic, and business models, laying the groundwork for an era defined by decentralization, inclusivity, and innovation.

To share an example, consider NATIX Network, which is developing a decentralized physical infrastructure network (DePIN) using smartphones as AI-enhanced cameras to gather critical data on traffic and road conditions in particular regions. Users can download a free dashcam application and keep it active while driving. The app transforms the video captured by the smartphone’s camera into anonymized data, and in return, users receive token rewards. In this case, the smartphones represent the tangible infrastructure, with the underlying network and reward distribution mechanism operating on a blockchain. HiveMapper is also doing this similarly with their own physical dashcam devices to be installed in user vehicles.

So why opt for a DePIN over existing centralized services? DePINs stand out in this regard, offering numerous competitive advantages over traditional models:

- Rapid Expansion of Network: By mobilizing public resources for tangible infrastructure, DePINs can scale quickly and cost-effectively, distributing the financial burden across network participants and balancing it with future growth and earnings. In the example above NATIX, with thousands of users, is mapping the world at an unprecedented pace, capable of real-time updates with sufficient network scale.

- Community Ownership: Rather than relying on centralized corporations primarily focused on quarterly earnings, communities can take ownership of the hardware that comprises their network, ensuring that goods and services align with their needs. For example, ELOOP’s car-sharing initiative allows everyone to earn when a vehicle is used, distributing a portion of the revenue among the community.

- Transparent Governance: Unlike traditional infrastructure initiatives that often lead to centralized control, DePINs operate with open, democratic, and accessible governance structures. A Web3 alternative to Uber, proposed by bloXmove, promises complete transparency in service pricing for both drivers and passengers, eliminating hidden fees.

- Reduced Capital and Operational Costs: By crowdsourcing both hardware and its maintenance, DePINs drastically reduce the capital and operational expenses associated with traditional business models. Network members manage infrastructure and support, sharing in the profits, in contrast to the substantial investments required by traditional companies building a similar network.

- Secure Peer-to-Peer Transactions: Leveraging blockchain technology, DePINs facilitate secure direct transactions between network participants, eliminating the need for intermediary payment processors and their associated fees as well.

- Web3 Ecosystem Integration: As native Web3 entities, DePINs provide direct access to a plethora of Web3 tools and decentralized finance (DeFi) services, such as financing for new hardware, opening up additional revenue streams for network participants.

The Genesis of DePINs

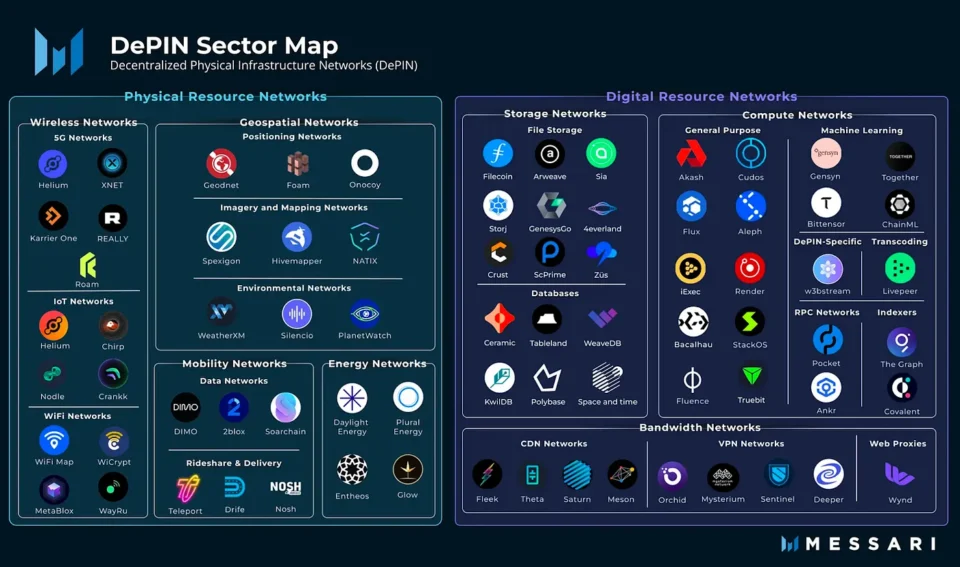

The nascent stages of DePINs are characterized by a sporadic yet significant emergence in sectors spanning energy, logistics, telecom, and mapping. Special-purpose resource networks, particularly focusing on digital commodities like compute, storage, bandwidth, and data aggregation, have become noteworthy contributors to this burgeoning ecosystem. These innovations are redefining the contours of market dynamics, operational efficiencies, and value propositions.

The evolution of these networks unveils structural-cost or performance arbitrages, accentuated by the enabling environment fostered by crypto-native capital formation. As DePINs continue to burgeon, a multifaceted ecosystem is emerging, characterized by diversification, specialization, and enhanced value creation. The networks are evolving, not in isolation but as intertwined entities, each influencing and being influenced by the dynamic forces shaping the DePIN landscape. Many well funded Web3 projects including Peaq, IoTex, Helium, Spexigon, Natix, Wynd and Pollen are tackling this exciting space in various subcategories of use cases spanning from telecommunications, supply chain detection to outright building an entire L1 ecosystem for dePIN projects to collaborate on.

Network Design: A Critical Analysis

Embarking on the journey of designing and deploying a DePIN is akin to navigating a complex labyrinth of choices, each with profound implications. The architecture of these networks is influenced by an intricate array of factors, including but not limited to hardware considerations, scalability thresholds, and demand generation dynamics.

Hardware manifests as the backbone of DePINs. Whether it’s a question of manufacturing proprietary hardware or adopting a community-driven open-source approach, each choice is laced with intrinsic advantages and challenges. The control, consistency, and quality assured by proprietary hardware are often weighed against the scalability, diversity, and resilience offered by open-source alternatives.

Hardware Implications in DePIN

DePINs, in their essence, are characterized by their foundational hardware. A critical decision revolves around whether to manufacture proprietary hardware or open-source the specifications. Each path is imbued with specific advantages and potential pitfalls. Proprietary hardware ensures quality control and consistency but could potentially introduce bottlenecks. Open-source specifications promote scalability and diversity but introduce challenges related to quality assurance and standardization.

The nature of hardware, whether active or passive, plays a pivotal role. Passive networks, characterized by minimal ongoing user engagement, often exhibit accelerated scalability. In contrast, active networks, demanding continuous user involvement, necessitate creative incentive structures to stimulate participation and value creation. The ease or complexity of hardware installation also emerges as a determinant factor, directly influencing the rate of network scalability and the profile of potential contributors.

Token Design Implications for DePIN Hardware

The dance between hardware and token design is intricate. Professional contributors, often focused on immediate, dollar-denominated returns, juxtapose against retail contributors who may be driven by long-term outcomes. Balancing these diverse motivations and behaviors is pivotal to fostering a dynamic, responsive, and engaged contributor ecosystem.

Token design and allocation strategies need to be meticulously crafted, balancing the immediate incentives required to stimulate early-stage participation and the long-term rewards necessary to retain, motivate, and engage contributors as the network matures.

Supply Inflection Points in DePIN

A supply side inflection point emerges as a pivotal milestone, marking the transition from a nascent network to one that is commercially viable. Achieving this scale is influenced by an intricate array of factors, including location sensitivity and network density. Each network’s journey to this pivotal milestone is characterized by its unique landscape of challenges and opportunities.

Networks demanding hyper-localized, high-density deployments necessitate enhanced token incentives to stimulate and sustain growth. In contrast, those with lower density requirements or location insensitivity can adopt a more conservative approach, pacing their token allocations to align with specific growth and scale milestones.

Supply side inflection points in the context of Decentralized Physical and Digital Networks (DePINs) are a critical juncture that underscore the transformation from a nascent network into a commercially viable ecosystem. They are characterized by the adequate concentration of resources and infrastructure that makes the network operable and profitable. Here, we dive deeper into the multifaceted elements of supply inflection point considerations. The teams at Spexigon, Helium and Pollen are all considering these trade-offs differently depending on network needs.

- Granularity of Location Sensitivity: DePINs often exhibit a range of sensitivities to location. Understanding this sensitivity in a granular manner, taking into account the intricate dynamics of geographical distribution and regional variations, is essential. Networks need to consider not only the broad geographical spread but also the micro-dynamics of location-specific influences, such as regulatory landscapes, consumer behavior, and specific regional challenges and opportunities.

- Network Density and Specialization: Network density is intricately linked to supply side inflection points. However, it’s not just about the volume but also the quality and specialization of nodes. Networks need to explore the intricate balance between generic nodes and specialized ones, each bringing distinct values and capabilities. Specialized nodes can enhance the network’s capacity to cater to niche, high-value segments, while generic nodes ensure broad-based coverage and accessibility.

- Evolution of Supply Inflection Point Metrics: As networks evolve, the metrics defining supply side inflection points are likely to shift. Initial metrics may be focused on quantitative aspects like the number of nodes, but as the network matures, qualitative elements, including node efficiency, contribution quality, and stakeholder engagement, become pivotal. Networks need to envisage an evolutionary model of supply side inflection point, where the criteria and benchmarks adapt to the network’s growth, diversification, and market dynamics.

- Flexibility in Resource Allocation: Flexibility in resource allocation emerges as a critical factor. A supply side inflection point is not a static milestone but a dynamic one, influenced by external market dynamics, internal network developments, and technological innovations. Networks need to build in mechanisms that allow for adaptive resource allocation, ensuring that the network can pivot and adapt to achieve supply side inflection point in diverse, changing conditions.

- Interplay with Tokenomics: The intricate interplay between supply inflection point achievement and tokenomics cannot be overstated. Token incentives, distributions, and allocations need to be meticulously aligned with supply inflection point milestones. This alignment ensures that tokenomics not only incentivizes the attainment of supply side inflection point but also evolves to sustain and enhance the network post this critical juncture.

Community Engagement and Participation

Community engagement is integral to achieving the supply side inflection point. It’s not just about the physical and digital infrastructure but also about the human capital that drives, sustains, and enhances the network. Strategies to engage, motivate, and retain community members, ensuring their active participation and contribution, are pivotal in ensuring that supply side inflection point is not just achieved but is also sustainable and growth-oriented.

Achieving a supply side inflection point in DePINs is a multifaceted challenge, encompassing a myriad of factors including location sensitivity, network density, tokenomics, technological innovations, and community engagement. It’s a dynamic, evolving milestone, characterized by adaptability, flexibility, and strategic alignment of resources, incentives, and infrastructure. Each network’s journey to the supply side inflection point is unique, influenced by its specific vision, mission, and market dynamics, necessitating a customized, adaptive, and strategic approach to navigate this intricate landscape.

Token Design Implications for Supply Inflection Points

Supply inflection points, as a concept, permeate deeply into token design considerations. Time-based token distribution strategies are often the refuge for networks characterized by high supply side inflection points and an imperative for rapid deployment. Utilization-based strategies, offering flexibility and adaptability, find resonance with networks characterized by lower supply side inflection points and nuanced growth trajectories.

Demand Side Generation and Hitting Escape Velocity

The crescendo of reaching supply inflection point transitions into the symphony of demand side generation. Here, networks face the strategic decision of becoming a Value-Added Reseller (VAR) or outsourcing this role. Each choice unfolds a distinct narrative of network growth, resource optimization, and customer engagement, influencing the network’s trajectory and value proposition.

VARs, whether internal or external, play a pivotal role in packaging and presenting the network’s resources in formats and constructs that resonate with end consumers. This intermediation layer is not just about sales but is integral to enhancing the accessibility, utility, and value proposition of the network’s resources.

Navigating the terrain of demand generation in the realm of Decentralized Physical and Digital Networks (DePINs) involves a strategic integration of technology, human interaction, market analysis, and innovative outreach. We embark on a deeper exploration of the nuances, strategies, and innovative approaches that characterize this intricate journey.

Structural Foundations of Demand Side Generation

- Clear Value Proposition: An unequivocal clarity of the network’s value proposition is fundamental. It necessitates an intricate articulation of the network’s offerings, distinguishing features, and the specific needs it addresses in the marketplace, laying a robust foundation for demand generation initiatives.

- Data Analytics and Insights: Harnessing data analytics and insights for an in-depth understanding of market trends, consumer preferences, and behavioral patterns is pivotal. It equips DePINs with predictive insights, enabling targeted demand generation strategies.

- Core Technology Innovation: The infusion of technology, especially AI and machine learning, enhances personalized, adaptive, and responsive demand generation strategies. They facilitate real-time adjustments, ensuring alignment with evolving market dynamics.

Strategies for Nurturing Demand

- Customer Journey Mapping: A detailed mapping of the customer journey, from awareness to conversion, is integral. It involves the identification of touchpoints, engagement triggers, and opportunities for enhancing the customer experience, driving demand amplification.

- Content Marketing Dynamics: Content emerges as a powerful tool for demand generation. Strategic content marketing, characterized by relevance, value, and engagement, enhances brand visibility, awareness, and attractiveness.

- Omni-Channel Engagement: An omni-channel engagement strategy ensures a seamless, integrated customer experience across digital and physical interfaces. It enhances accessibility, convenience, and engagement, propelling demand amplification.

Token Design and Demand Side Generation

- Token design is intricately connected to demand generation. Enhancing token utility, value perception, and usability fosters demand growth. Strategies include utility diversification, staking benefits, governance participation, and reward mechanisms.

- Dynamic token models that adapt to market changes, network evolution, and stakeholder expectations ensure sustained demand. They involve adaptive emission schedules, value capture mechanisms, and participatory token evolution strategies.

Market Evolution and Adaptive Strategies

- An acute sensitivity to market changes, competitive dynamics, regulatory landscapes, and technological innovations is pivotal. It ensures that demand generation strategies are adaptive, responsive, and future-oriented.

- The integration of innovations, both technological and strategic, enhances the network’s value proposition. It ensures that the network remains at the forefront of market trends, attracting and retaining demand.

Demand side generation in the intricate landscape of DePINs is characterized by strategic adaptability, technological integration, data-driven insights, and customer-centric approaches. It’s a dynamic, evolving domain where the confluence of technology, strategy, innovation, and market insights drives the network’s market penetration, brand equity, and value proposition. Every aspect, from token design to VAR dynamics and content strategies, plays a pivotal role, weaving an intricate tapestry of demand generation that’s as dynamic, diverse, and adaptive as the DePINs themselves.

Token Design Implications for Demand Generation

Tokens weave into the demand generation narrative as instruments of incentive, engagement, and value creation. Networks, especially those reliant on third parties for demand generation, often deploy tokens as milestones-based rewards, aligning network and third-party objectives and fostering a symbiotic growth ecosystem.

In the complex architecture of DePINs, token design emerges as an essential cornerstone, particularly pronounced in the sphere of demand generation. Here, the role of tokens transcends beyond a medium of transaction or an asset of value; they morph into strategic instruments that drive network engagement, facilitate value exchange, and catalyze network growth and scalability.

- Aligning Incentives with Network Growth: One of the core considerations is how to intricately align the incentives of all stakeholders. Tokens in the context of demand generation are not merely about rewarding participation; they become the means to align the interests of the network, VARs, end consumers, and other stakeholders. This alignment is not static but dynamic, evolving with the growth, diversification, and maturation of the network.

- Customized Token Structures: Customized token structures emerge as a potent strategy to cater to the nuanced needs and expectations of different stakeholders. The creation of specialized tokens, each with defined roles, rights, and privileges, enables networks to cater to the diverse and often complex landscape of demand generation. Each token type can be meticulously designed to drive specific behaviors, engagements, and contributions, crafting a multi-dimensional incentive structure that fuels network growth and value creation.

- Token Utility and Functionality: The utility and functionality of tokens in this context extend beyond mere value representation. Tokens can be embedded with specific functionalities that enhance their utility, such as governance rights, access privileges, or utility within decentralized applications built atop the network. This multifaceted utility transforms tokens from passive assets to active participants in the network’s ecosystem, driving engagement, participation, and value exchange.

- Dynamic Token Models: Dynamic token models that adapt to the evolving needs, challenges, and opportunities of the network are pivotal. Such models incorporate mechanisms to adjust token supply, distribution, and value in response to specific triggers, ensuring that the token ecosystem remains responsive, adaptive, and resilient to the multifarious forces shaping the network’s landscape.

- Balancing Short-term and Long-term Incentives: Striking a balance between short-term incentives to drive immediate engagement and long-term rewards to ensure sustained participation becomes critical. This balance is not a fine line but a spectrum, where networks can deploy a combination of immediate rewards, milestone-based incentives, and long-term value propositions to engage, motivate, and retain stakeholders.

- Token Governance: In the sphere of demand generation, governance emerges as a pivotal aspect. Decisions regarding token allocations, distributions, and utility are integral to the network’s growth and value proposition. Incorporating mechanisms that facilitate participative, inclusive, and transparent governance fosters an environment of trust, collaboration, and innovation.

- Analytical Insights and Data-Driven Decisions: In this complex landscape, the role of data and analytics is pronounced. Networks can leverage intricate data analytics to gain insights into token circulation, utilization, and holding patterns. These insights become the foundation for informed, strategic decisions that optimize token design, allocation, and distribution to drive demand generation.

In essence, in the vibrant, dynamic world of DePINs, tokens are not mere digital assets. They are strategic instruments, each imbued with the potential to drive network growth, value creation, and innovation. In the sphere of demand generation, tokens transcend their traditional roles, morphing into catalysts that align interests, incentivize participation, and foster a vibrant, engaged, and value-driven ecosystem. Each token, each design decision, and each strategic allocation is a brushstroke in the intricate masterpiece of decentralized, integrated physical-digital networks.

DePINs are not just networks; they are value compounding ecosystems. Each is characterized by a unique interplay of hardware, tokens, supply side inflection points, and demand side generation strategies, contributing to a rich tapestry of decentralized, physical-digital integration. As we delve deeper into this intricate world, every insight, discovery, and innovation adds a layer of depth, unveiling a universe where the physical and digital are not just coexistent but are intricately and seamlessly intertwined. Our team at Struck Crypto is deeply interested in uncovering the value these token incentivized physical networks can unlock for a more inclusive Web3 future.

Key Sources:

- Peaq Network, Helium, Spexigon, Hivemapper

- IoTex, Pollen, Wynd

- Solana DePIN network of projects

- Web3 VC Network conversations and insights

- Messari Research

- The Block

- CoinTelegraph

Disclaimer

The information provided in this blog post is for educational and informational purposes only and is not intended to be investment advice or a recommendation. Struck has no obligation to update, modify, or amend the contents of this blog post nor to notify readers in the event that any information, opinion, forecast or estimate changes or subsequently becomes inaccurate or outdated. In addition, certain information contained herein has been obtained from third party sources and has not been independently verified by Struck. The company featured in this blog post is for illustrative purposes only, has been selected in order to provide an example of the types of investments made by Struck that fit the theme of this blog post and is not representative of all Struck portfolio companies.

Struck Capital Management LLC is registered with the United States Securities and Exchange Commission (“SEC”) as a Registered Investment Adviser (“RIA”). Nothing in this communication should be considered a specific recommendation to buy, sell, or hold a particular security or investment. Past performance of an investment does not guarantee future results. All investments carry risk, including loss of principal.